Source: Nishizawa Research Institute

Author: Zhao Jian is the Dean of the Xize Research Institute, Shandong University Economic Research Institute, Jinan University Business School, Nanjing University Yangtze River Industrial Economics Research Institute, Chinese University of Hong Kong (Shenzhen) professor, tutor, and researcher; member of China New Supply 50 Forum .

Zhao Jian, Dean of Nishizawa Research Institute

Although there is wisdom, it is better to take advantage of the momentum; although there is a foundation, it is better to wait for the time.

-“Mencius-Gongsun Chou Shang”

Contents of this article:

- Those that are in line with future trends are truly valuable

The deep root of the decline of value investment: the aging and distortion of financial accounting information

The dilemma of value investment in the era of digitization, monetization and bubble

Trending Investment: Stay up to date and take advantage of the trend to live up to your youth

(The full text is 6,700 words, and the reading time is about 9-12 minutes)

1. Those that are in line with future trends are truly valuable

“The era when value investment is king has passed, and now it is the world of trend investment”

“Being friends is not time, but cycle”

“The only constant in the world is change, and every major change has a trend.”

“Only those that are in line with the trend have investment value”

“It is not the past that defines the present, but the future”

“Is Moutai a value investment? Such a high valuation is definitely not”

Ms. Liu Yang, Chairman of the Board of Directors of Nishizawa Investment and a legendary investor, has criticized the “metaphysics” of value investment on many occasions, advocating that in this era of new discoveries, new changes, and new things every day, we should jump out of the cognitive prison of the past. ,use Trending Investment The concept and method of capturing the “unicorn” under the digital wave.

Of course, compared to value investment supported by static financial data, trend investment based on future development potential may require a combination of science and art. This also increases the difficulty of decision-making and judgment, and at the same time makes some fraudulent behaviors such as fake trends and “PPT” bubble narratives become popular.

However, if all investors choose the target according to the standard of value investment, then there will be no unicorns in the digital age such as Alibaba, Facebook, Tesla, Amazon, and Apple. Because of the value of these emerging companies (such as the innovative spirit of Musk and Jobs), it is impossible to use financial data such as accounting statements to measure and discover. In this sense, value investing is too mediocre and lazy-the financial indicators of business operations reflect only the past.

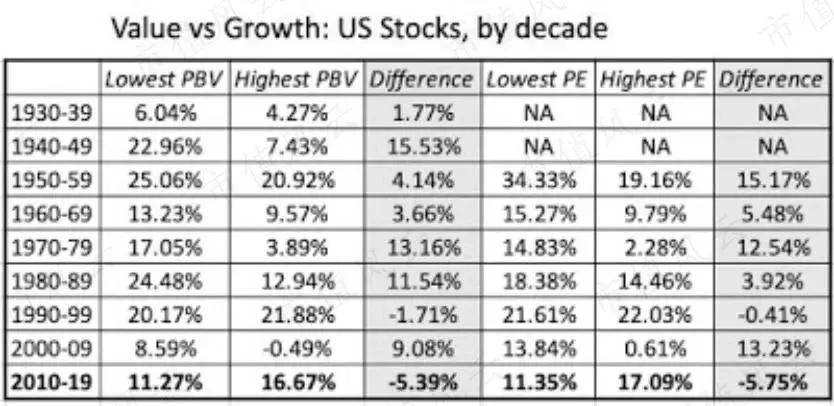

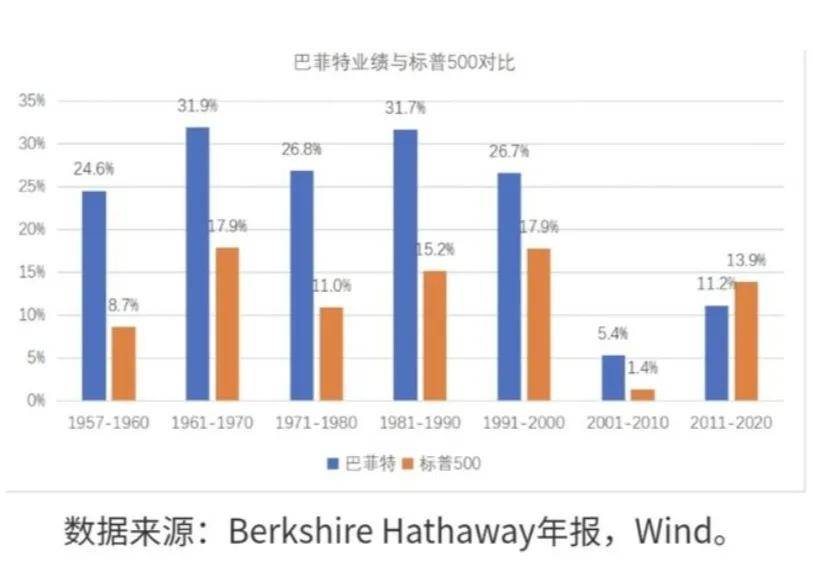

In fact, in the past two decades, the rate of return on value investment has become less and less than in the past. Especially in the last ten years after the subprime mortgage crisis, the return on value investment underperformed the broader market index, or even lower than most passive management. Because now the emerging companies (FAANG, Facebook, Apple, Amazon, Netflix, and Google) that determine the US stock market index are no longer understandable and valued by value investment relying on accounting information.

2010-2019: The performance of value stocks is far below that of growth stocks (Via Ken French)

Value investment is old, or the entire system needs to be updated, iterated, or even rebuilt. There are four core reasons:

First, the decision-making information system on which value investment depends can no longer reflect the true value of emerging companies .The basic information that value investment relies on is traditional accounting information, but Accounting statements born in the era of heavy industrialization , There have been basically no major changes in the past 100 years, and it reflects the information of material assets in the era of heavy industry. There is no way to accurately measure intangible resources such as the core innovation capabilities, entrepreneurship, human capital, digital assets, organizational vitality, and culture of emerging companies in the information revolution and the digital age. . In other words, according to the financial indicators of value investment, it is impossible to capture the unicorn of the digital age.

The famous scholar Baruch Lev used empirical methods to prove a conclusion in “The Decline and Revival of Accounting”: In the capital market, Accounting statements contribute less than 5% of incremental information to investors ! Moreover, various accounting “fakes”, whether it is illegal fraud or legal statement whitewashing, not only fail to guide investors correctly, but also create a lot of noise and false signals to mislead value investors to make wrong valuations.

Second, a static valuation system based on historical data has been unable to adapt to the “era of great changes” under the digital wave. The information that value investment relies on is all historical data, or calculating the future based on historical data is equivalent to using the past to price the present. If we say that in the era of heavy industry with greater certainty and stability, this kind of valuation system can still prevail, but in the digital era full of uncertainty and various new things, the pricing of a high-quality company should be mainly based on future development Trends, not past information that is “dead” and full of false signals.

Historical data-mainly the financial statement information of the company-certainly has a strong objectivity and authority. In the industrial age where environmental changes and technological changes are slow, past and historical data can be better used to deduce the future, and the deviation may not be particularly large. However, information and digital technologies are changing with each passing day, the market environment and user preferences are elusive, and various new things emerge unknowable, causing future expectations based on historical data to fail. The truly outstanding investors in this era basically do not rely on historical accounting information but rely on forward-looking judgments on major trends.

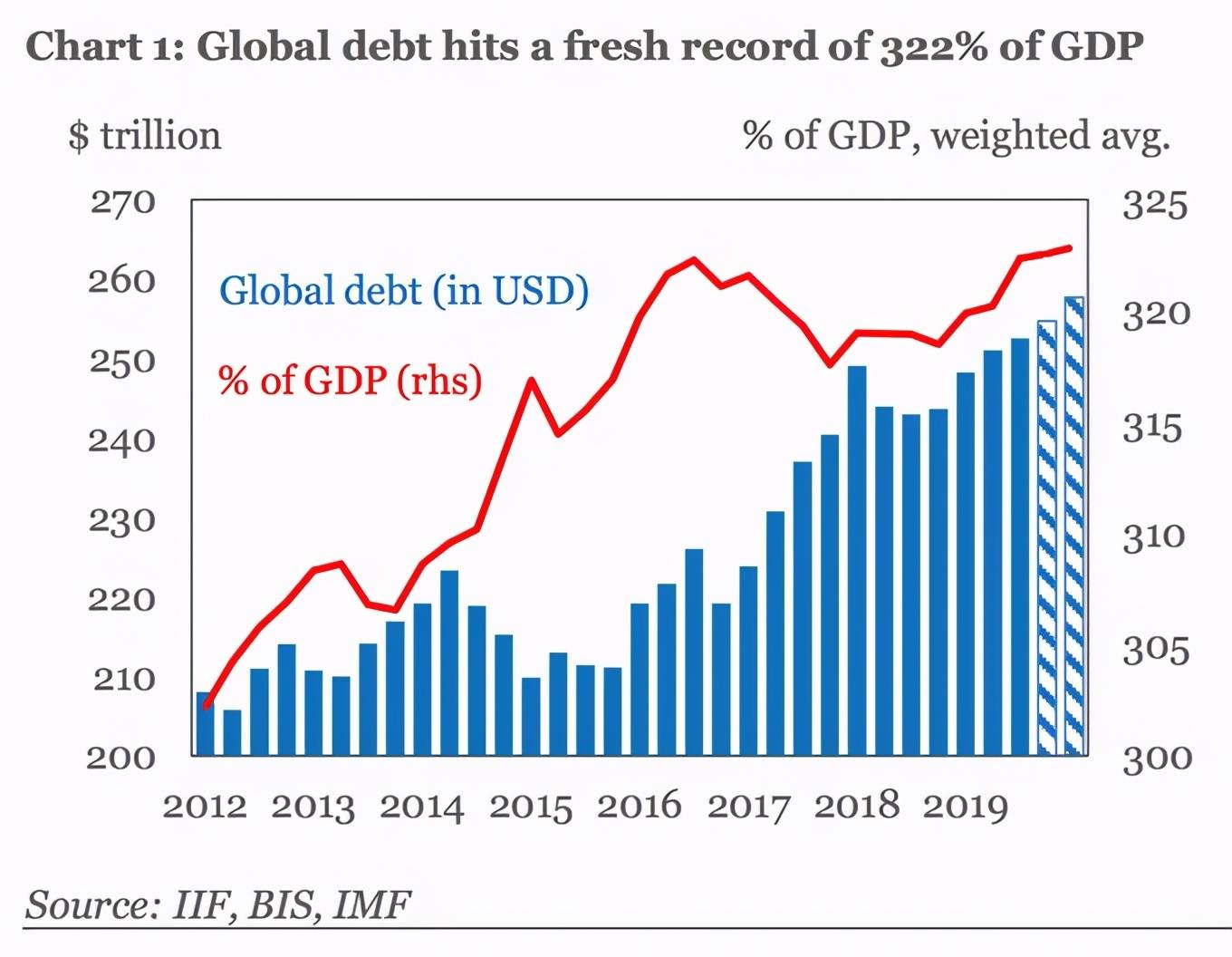

Third, under the debt explosion and the global monetization trend, the traditional value valuation system has been strongly impacted by “dummy variables” such as debt, currency, and liquidity, and the fundamentals have become more and more important as the core variables of pricing. less . We know that value investing mainly relies on fundamental variables. However, since the subprime mortgage crisis, the world has continued to release unlimited amounts of water, and the risk-free interest rate has been pushed down to 0 or even exceeded the lower limit and became negative. With the cost of capital being so low and the availability of funds more and more accessible, the amount of high-risk speculative and high-frequency trading capital is increasing, and it is becoming more and more dominant in the valuation system of the capital market. These transactional capitals most favor growth stocks that are full of imagination and huge valuation space, but are not interested in those stocks that have lower valuations and are more favored by value investment. “Cheap is not good, good goods are not cheap” is actually the valuation paradox of value investing-if the market is efficient, then those stocks that are undervalued in the view of value investing have no investment value.

Fourth, in the digital and information age, the information sources and databases that investors rely on for decision-making are becoming more and more diversified, and more and more real-time. In comparison, value investment that mainly relies on financial accounting statement information is lagging and aging. . Half a century ago (the most glorious era of value investment), the information system was underdeveloped, especially the lack of information channels for individuals. The financial accounting statement system became the main information channel and was monopolized in the hands of a few institutions. Today’s information explosion, the wave of digitization is sweeping everything, personal data and information terminals are completely popularized, the monopoly of information and data has been broken, and investors have more and more information sources for valuation of asset targets, which can better support trend investment . And value investing still sticks to financial data and report information full of false signals. The formation cycle of financial statements is too long, the short is quarterly, and the long is annual. In today’s changing times, an information system with such a slow frequency of information changes is certainly unable to make timely and forward-looking decision support for investment.

In fact, we do not deny the basic principle of value investing, namely Insist on investing in valuable assets . But the question is, what is a truly valuable asset and how to define the term “value”.The philosophy we insist on is very simple, that is “Only what is in line with the development trend of the times is truly valuable “.

And we were surprised to see that in recent years, those investors who declared value investment and long-termism to the outside world still made trend and cycle money in the end. We can only be in awe of time, the long river of time can refresh and bury everything. It is the cycle that can be friends with us, and only the cycle can give us the opportunity to truly discover and create value.

2. The deep root of the decline of value investment: the aging and distortion of financial accounting information

In the pedigree of investment ideas in the stock market, technology investment is earlier than value investment. In 1905, after more than ten years after the emergence of the Dow Theory’s trading technology analysis method of the stock market, an important analysis method and investment method for judging the stock price and investment from another angle was born-fundamental analysis method and value investment method . This analysis method has been continuously developed in practice, and has been valued and used for nearly a hundred years, and has become a classic mainstream value investment school.

The founder of the value investment method was Graham, the teacher of Warren Buffett. He wrote a masterpiece “Securities Analysis” in the 1930s. In the book he created a theoretical system of basic analysis methods, expounding the value investment main content. In Graham’s view, The stock price is the external manifestation of the internal investment value of a listed company. To buy a stock is to buy a listed company. Therefore, the analysis of the investment value of listed companies is the main method to choose stocks. Graham also believes that The analysis of the investment value of listed companies is mainly the analysis of the financial situation of listed companies, mainly analyzing the balance sheets and income statements of listed companies.Investors should evaluate the intrinsic value of their stocks based on the asset situation and performance of the listed company, so as to judge the level of its stock price .

Warren Buffett is a faithful practitioner of Graham’s theory. According to his memoirs and biography, there is no stock exchange quotation in his office. There are only piles of financial statements and analysis reports of listed companies He also never trades short-term stocks, but finds the company with the most investment value from numerous listed companies and makes relatively long-term investments in it.

From the perspective of the history of the development and evolution of value investment, there are mainly two distinct characteristics: first, The foundation of value investment reliance is financial accounting information , Mainly the balance sheet and income statement (income statement); second, Value investment was born in the era of the second and third industrial revolutions. The high-quality enterprises produced by these two industrial revolutions are mainly based on tangible assets that can be accounted for. .

In this way, the reasons for the decline of value investing are clear:

the first, Financial accounting information has increasingly lost the accuracy of measuring corporate value The main reason is as Baruch Lev said in “The Decline and Revival of Accounting”, the basic framework and standards of accounting have not undergone major adjustments for more than 100 years. In the past hundred years, three industrial revolutions have occurred, and financial capitalism has widely emerged. However, accounting still adheres to the basic concepts and framework of a hundred years ago, and has not made corresponding adjustments with the changes of the times.

Second, modern accounting standards and frameworks are actually still products of the industrial age. They are mainly The measurement of tangible assets in heavy industry enterprises simply cannot reflect the corporate value information with innovation, creativity, talents, culture, etc. as core resources in the current wave of the fourth industrial revolution. Therefore, it is impossible to truly capture the leading companies in the digital age.

third, The quality of accounting information itself is getting worse and more distorted . Leaving aside those blatant frauds and frauds, it is difficult for ordinary investors to identify and observe “accounting whitewash” within the requirements of accounting standards. Today, with more and more diversified information sources, accounting information can no longer be used as the basic basis for valuation. This also means that the traditional value investment system is gradually being abandoned.

3. The dilemma of value investment in the era of digitization, monetization and bubble

Modern financial activities are being affected by Three waves of the era The effects of Digital wave based on the fourth information technology revolution , It changes the technological environment of financial investment activities; based on Monetization wave under the background of the fourth wave of global debt explosion , The global super monetary easing after the two major crises in the last ten years-the subprime mortgage crisis and the pandemic crisis; Financial asset bubbles under long-term low interest rates, zero interest rates and negative interest rates , The typical performance is the US stock market, Chinese real estate, Japanese and European national debt. Of course, the definition of a bubble is currently uncertain. Many people do not agree with the current tendency to bubble and believe that a bubble can only be recognized after it bursts. What we are adopting here is the standard of value investment, thinking that a bubble is a large deviation from the long-term average price (used to measure value).

however These three waves are making the value investment system that has prevailed for more than half a century be troubled. . First of all, digitization has increased the volatility of the financial market. The diversification of information sources, quantitative investment based on digital technology, and passive management prevail. Various online social platforms, digital communities, and self-media have broken the mainstream media’s monopoly on financial information dissemination channels. Make traditional value investment based on static financial accounting information at a loss . In particular, the rapid development of digital technology coupled with the popularization of digital smart terminals, Narratives based on behavioral finance and psychoeconomics are widely popular. The market’s pricing of investment targets no longer focuses on “boring” and “old” accounting information, but on the stories widely circulated in the market. “Red” stocks and the flow of entrepreneurial big V . Of course, from a traditional perspective, the “net celebrity” of these assets and the “big V” of entrepreneurs certainly have a bubble component, but under the sweep of the digital wave, people are more inclined to think that narratives form a consensus. , With stronger valuation support. Those companies that look “cheap” in terms of financial information have actually lost the trust and favor of the market.

The monetization wave is the second biggest factor that causes value investment to get into trouble. Too much currency in the process of chasing a small number of core assets has generally pushed valuations far beyond the understanding of value investors . Value investors can only be forced to raise the valuation standards and pick up some old assets that are easy to “pit” in the market, which seem to be cheap and actually expensive (for example, Buffett admits that it was a mistake to invest in aviation stocks because of PE’s low investment). In the past decade or so, the wave of monetization has risen one after another, from three QEs in the United States after the subprime mortgage crisis, to the European debt crisis in the euro area, and then to the global “unlimited” monetary easing after the pandemic. It seems that the monetary rules and fiscal discipline that had a bottom line in the past no longer exist. The consequence of this is that global liquidity is surplus, core assets are starved, and interest rates have long been suppressed at a very low level, close to zero or even negative. This obviously amplifies or distorts or even destroys the value investment system . I focused on this issue in my previous article “Zhao Jian: The financial market has been “hyperinflation”, and the money printers have destroyed the value investment system.” Long-term low interest rates and excessive liquidity have caused value investment to lose the basic pricing anchor, and the entire valuation must be greatly increased. . Because the risk-free interest rate, which is the discount rate, continues to decrease at the denominator end. Moreover, the emergence of negative interest rates requires us to revise the discounted cash flow model, which is clearly beyond the framework of traditional financial models. In this sense, it is not so much that the valuation of financial assets has risen sharply, as it is that the value of currency continues to collapse.

Bubbles are the object of hatred by value investors, but today’s world is full of bubbles. If you follow the standard of value investment, the best strategy now is to use cash as the king and wait for the bubble to burst and pick up cheap “value return” assets.However, the reality is definitely not the case . First of all, theoretically, the definition of a bubble itself is quite controversial, and many people even think that there is no bubble at all. According to the standard of value investment, a bubble is the deviation of price from actual value. But what is “real value”? This returns to the old question, or to the philosophical level of metaphysics. However, the reality is that bubbles exist everywhere and exist for a long time. From the point of view of value investors, current financial assets are very expensive, cost-effective, and do not meet the standards of value investment. But the reality is, The modern economy itself is a bubble economy measured by money , Not so much that core assets are getting more expensive, it is better to say that credit notes are getting cheaper. If you change the coordinate system and use physical assets or stocks of high-quality listed companies as the value standard to measure the current core assets, it is actually not that expensive (for example, the currency measurement system composed of the FAANG index). Bubbleization and monetization are closely linked, because the value scale of all major types of assets is traditional legal currency, mainly U.S. dollars. But now the U.S. dollar expands almost indefinitely, The so-called bubble is nothing but a bubble in the US dollar, a bubble in all legal currencies .

The three waves of digitization, monetization and bubble are superimposed, It gave birth to a new alternative asset or a new type of currency in the future-encrypted digital currency . The “super bubble” of cryptocurrencies such as Bitcoin is the ultimate manifestation of the superposition of these three waves. However, in the eyes of value investors, encrypted digital currency is the “biggest scam” of this era. This judgment happens to announce the inevitability of the decline of value investment-the fall of a system of thought and belief, precisely from the pretentious and hostile towards new things (rather than trying to understand why it exists).

4. Trending Investment: Stay up to date and take advantage of the trend to live up to your youth

There is a popular saying in the investment world called “being a friend of time”, or long-termism. It sounds reasonable and idealistic, but reality is full of irony: most of the time, it is because of being stuck and forced to be friends with time. Of course, it is also a common sentence used by investment managers to comfort their clients. Managers of course hope that customers will always be “friends of time”, which can reduce the redemption pressure and charge more management fees.

A truly outstanding investor must put himself in the general trend of the development of the times, and capture high-quality assets that represent the theme of the times in each phase of the medium and long-term changes. And in accordance with the changing trend, do a good job in the management of assets, funds and capital, and balance the relationship between profitability, liquidity and safety, so as to better meet the needs of customers with different risk preferences and liquidity preferences. In this sense, being a friend of time is worse than being a friend of cycles. In the face of mysterious time, only the cycle is meaningful for investment, otherwise no amount of time will be a repetitive cycle. Just like we ridicule A shares, it has been ten years, but it has returned from one 3000 points to another 3000 points.

In fact, there may not be absolute value investment, because the essence of the capital market is the valuation of the future, and the judgment of the future must be placed in the internal development trend.Therefore, the success of value investment and the huge gains obtained are, in essence, the excess gains given by the trend. . We look back at Greenham, and the era when Buffett’s investment was the most successful and with the highest rate of return was precisely the era when the second and third waves of industrialization emerged. Therefore, their excess return is actually a bonus gifted by the general trend of the times.

Value investing was very successful in that era. Another key point is that the accounting information in the heavy industry era can better reflect the value of the enterprise, because the core assets of the leading enterprises in the industrial era are all tangible material assets. Accounting is very effective in measuring tangible assets. At the same time, the method of “judging future trends based on historical data” in that era was also relatively effective, because that era was not like today’s digitalization and monetization, and the era of major changes unseen in a century. Most of the time, historical experience cannot be used as a definition of the future. The foundation may also become a kind of bondage.

In fact, value investment and trend investment, left-hand trading and right-hand trading, are not completely opposite in nature. There is an element of trend investment in the concept of value investment, that is, assets whose prices deviate from value have a strong tendency to return to value. Trend Investment also recognizes the basic concept of value investing, that is, investing in companies that are truly valuable. But from the nature of decision-making methods, value investment can be regarded as a special case of trend investment: judging future trends based on financial accounting information. Obviously, in the current era of continuous changes and new things emerging, it is obviously not enough to rely on financial statement information as one of the information sources to judge the future development trend of an enterprise.

Mencius said: Although there is wisdom, it is better to take advantage of the situation; although there is a foundation, it is better to wait for the time . In fact, most successful value investors do not rely on their own efforts to find a good target with the financial analysis method of value investment. The vast majority of the time is just a gift of the times-they just follow the trend of the cycle. Excess return . In this sense, Trend Investment knows how to respect the market, respect time, and respect value. Value investing has achieved great success because it coincides with the development trend of the macro economy and enterprises.

Each era has its own major themes and major trends. This era is an era full of glory and dreams. It is an era in which endless opportunities are bred amidst changes and turbulence. It is also an era in which old things are quickly eliminated and new things emerge quickly. Time is easy to get old, and time is easy to pass. It is of course easy to be a friend of time and “lay flat” in a complex and ever-changing market, but for a good investor with dreams, he still needs to use his own professional knowledge and comprehensive knowledge. , In the global and Chinese economic cycle, to find the general trend that can create value for customers. Only in this way can we live up to time and time.

(Source: Baidu, stocksnap.io)

[OriginalbyNishizawaResearchInstitutewelcometoforwardandreprintPleaseindicatethesourcethankyou!】

You must log in to post a comment.